Fundamentals for Tax

Where can I finally learn Tax Easily?

"I am a medical practitioner, or freelancer, which form do I fill up?"

How to deduct my tax payable as a business owner?

Good news to you,

you have come to the right community!

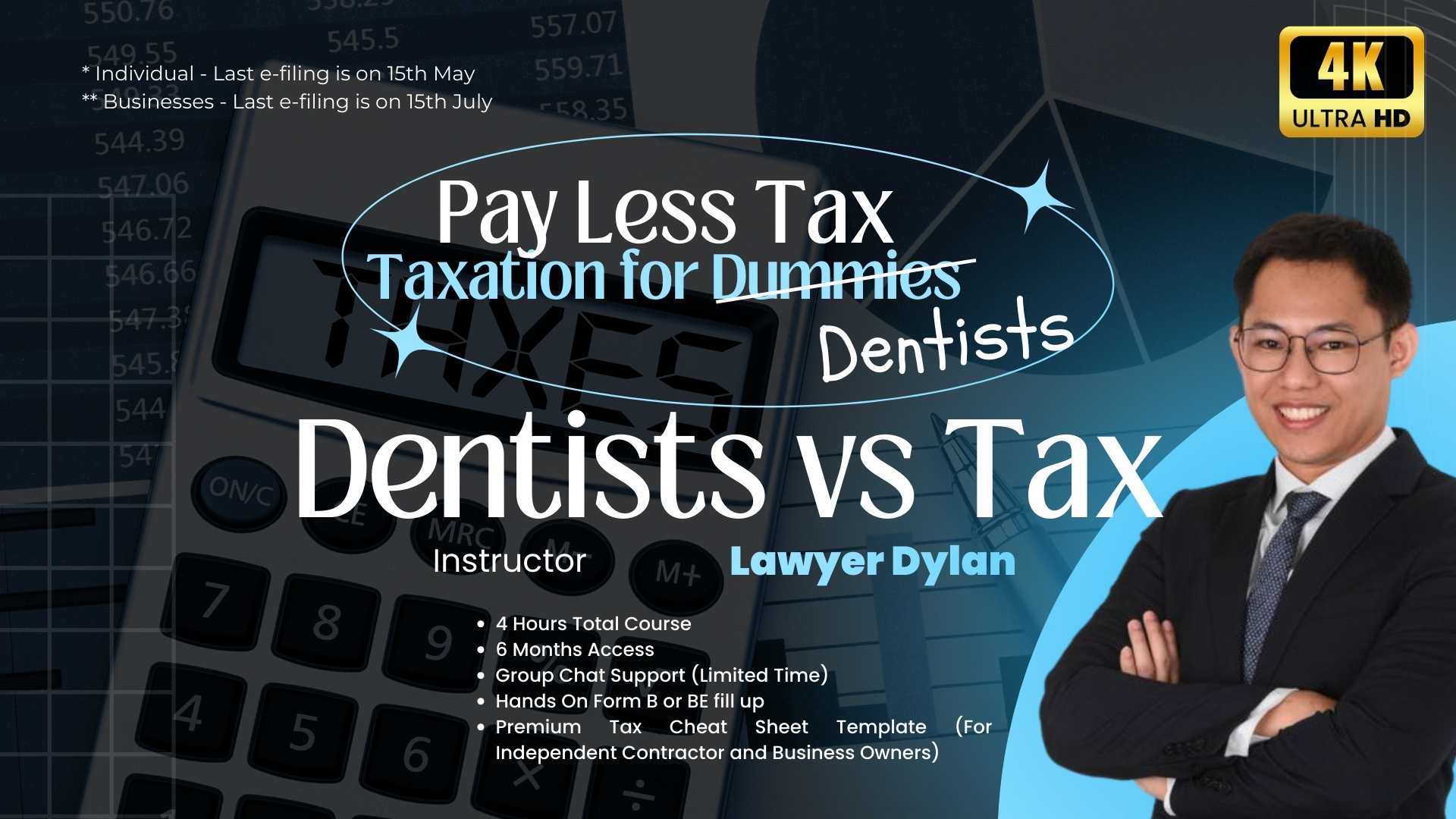

Pay Less Tax | Taxation for Dentists

Helping dentists achieve lifelong knowledge in Taxation

Learn one time, practice your entire career and never have to stress about tax.

We have designed this course to help you about the tax, easily, as a dentist,

This course is suitable for young dentists, private practitioners and clinic owners or accountant / tax agent that manages dental clinic's accounts.

If you are a Malaysian citizen and would like to know

how to have maximum tax savings,

this course is for you.

It consists of 5 Comprehensive Modules, Group support that are

4K Quality,

*Complementary Tax Cheat Sheet for Business Owners and Independent Contractors*

After attending this course, you are able to know which form to fill up, the secrets on how people actually get to save on taxes, and how you can fully maximise tax planning and enjoy the benefit of more vacation.

NOW AVAILABLE

Learn hard anonymously, Let the success be your noise.

Start your journey below ⬇️

RM799 nett

Why is it worth it?

Imagine not having to overpay your tax every year,

maximize your tax planning and use the extra money for

your company growth instead.

FREE

Business and Independent Contractor

🔥Tax Cheat Sheet

🔥 Unlimited Watch Times

*Register and create account to watch

*6months validity | *Unlimited watch time

Premium Course | Dental / Medical

10 lessons

Advanced

This comprehensive course teaches clinic owners, particularly doctors, on how to optimize cash flow and maximize deductions in a legitimate way where you will never learn elsewhere.

Join us in this journey for Tax Planning for Dental and General Practitioner Clinic where Lawyer Dylan will teach you how to maximize your tax planning for expenses and preserve more cash flow for your 1st year start up clinic.

Key Features:

🔥 7 Hours Total Course

🔥 10 Modules

🔥 12 Months Access

🔥 Pure secrets and no BS

🔥 Group Chat Support (Limited Time)

Suitable for Clinic owners, SME, Accountant, Tax agents, Contractor,

Employee and Business Owners.

Dentists | Premium Course

7 lessons

Moderate

This comprehensive online module is designed for dental professionals looking to enhance their expertise in tax management and optimisation. The course provides an in-depth exploration of all aspects of taxation relevant to dentists, including income categorisation, allowable deductions, tax planning strategies, and the legal framework surrounding dental practice taxation.

Key Features:

🔥 4 Hours Total Course

🔥 5 Modules

🔥 6 Months Access

🔥 Pure secrets and no BS

🔥 Group Chat Support (Up until 16th July 2024)

🔥 Hands On Form B or BE fill up

🔥 *UNLOCK* Premium Tax Cheat Sheet Template, For Independent Contractor, Employee and Business Owners

Suitable for

𝐌𝐨𝐝𝐮𝐥𝐞 𝟏 - 𝐅𝐨𝐫𝐦 𝐁 𝐨𝐫 𝐅𝐨𝐫𝐦 𝐁𝐄?

👉🏻 Threshold to file Form BE or Form B?

👉🏻 Penalty if submit tax return out of time

👉🏻 Identify my sources of Income

👉🏻 What if I have multiple sources of income

👉🏻 Employee vs Independent Contractor

👉🏻 The Control test - What is the test?

👉🏻 Contract for Service vs Contract of Service

👉🏻 s.4(a), s.4(b) & s.4(f) - the difference between business income, employment income, and other income

👉🏻 Criteria of a Business income

👉🏻 How can dentists recognize their income as business income

👉🏻 What is the substantial test to opt for Form B?

👉🏻 What is the statutory business income for professionals?

👉🏻 Benefit of employment income & business income

👉🏻 Tax Relief - what to claim (Dentist context)

👉🏻 Cosmetic Dental Treatment: is it claimable as tax relief for patients?

𝐌𝐨𝐝𝐮𝐥𝐞 𝟐 - 𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐚𝐧𝐝 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐢𝐧𝐠 𝐅𝐨𝐫𝐦 𝐁

👉🏻 What consists of a Form B?

👉🏻 Type of deduction - allowable expenses, double deduction, and special deduction

👉🏻 Capital Allowance vs Small Value

Asset for dental & dentist - How to maximize the claim for CAPEX/CA vs Small Value Assets?

👉🏻 Advantage of Form BE & Form B?

👉🏻 How to deduct business expenses? 👉🏻 What can and cannot be deducted?

👉🏻 Business deduction - entertainment, rental, salary, commission, bad debt, traveling, repair and maintenance, advertising fee

𝐌𝐨𝐝𝐮𝐥𝐞 𝟑 - 𝐏𝐫𝐚𝐜𝐭𝐢𝐜𝐚𝐥 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬 𝐚𝐧𝐝 𝐂𝐚𝐬𝐞 𝐒𝐭𝐮𝐝𝐢𝐞𝐬

👉🏻 Practical case studies on how Mr. July managed to have tax savings of RM13,000 after converting to file Form B instead of Form BE

👉🏻 How to fill up Form BE?

👉🏻 How to fill up Form B?

👉🏻 What is aggregate income & statutory income?

👉🏻 How to claim Capital Allowance?

👉🏻 What is initial and annual allowance?

𝐌𝐨𝐝𝐮𝐥𝐞 𝟒 - 𝐂𝐚𝐬𝐞 𝐒𝐭𝐮𝐝𝐢𝐞𝐬 𝐚𝐧𝐝 𝐋𝐞𝐠𝐚𝐥 𝐂𝐨𝐧𝐬𝐢𝐝𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐬

👉🏻 Case studies on expenditure deductible for dentist

👉🏻 Case studies on expenditure deductible for dentist

👉🏻 Case Law: Can dentists (Independent Contractors) form a Sdn Bhd to reduce their tax payable?

👉🏻 Case Law 1: Can dentists (Independent Contractors) form a Sdn Bhd to reduce their tax payable?

👉🏻 Case Law 2: How a Specialist (Medical) runs his own Sdn Bhd and yet being taxed on personal taxes

𝐌𝐨𝐝𝐮𝐥𝐞 𝟓 - 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬 𝐚𝐧𝐝 𝐐&𝐀

👉🏻 Tax Appeal

👉🏻 What is CP500?

👉🏻 How to file for revision of CP500?

👉🏻 What is Form Q and Form N?

👉🏻 Preparation of Capital Statement

👉🏻 What if I don’t file tax return on time? 👉🏻 Government of Malaysia v Jho Low (2023)

Testimonial

from Dr. Nabilah Sarawak

A lesson every working dentists should know,

No bs, 100% practicality.

For any enquiries, Whatsapp:

+6010 2828 359

Email : dlearn.guru@gmail.com